Triton Capital Fund

Innovative Alternative

Asset Management

Triton Capital Group is a global alternative asset manager built around the knowledge

accumulated over many decades across investment strategies. Seasoned industry

experts work together to identify and qualify unique opportunities that fall within the

criteria of our Investment Philosophy.

Real Estate Fund

Triton Capital’s Opportunistic Real Estate Fund aims to capitalize on market opportunities primarily in judiciary auctions presented in the acquisition and resale of foreclosed properties in local Brazilian jurisdictions. The decentralization of the auctions (local courts/agencies/banks) and the vast size of the country, allows for a professional investment team to seize attractive returns through its in-depth market knowledge, extensive experience, transactional structure, legal teams and sales execution network.

Our Firm

Triton Capital Group is a diversified alternative asset management firm pursuing diverse and unique opportunity sets across different industry sectors, asset classes, and geographies.

Investment Simulation

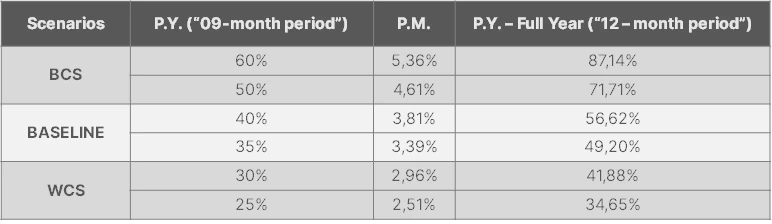

Throughout the entire transaction process from purchasing each property to sale, it will take an average of 6 to 9 months. Based on this premise, we have the following return expectations in gross terms, including our Best Case Scenarios (CMC), Base Scenario and Worst Case Scenario (CPC) in Reais:

The above figures are net of any costs related to the selection, acquisition and sale of the property, but do not include the fund’s administrative operating costs, as well as hedging costs. Since 2019, the local investment team in Brazil has been involved in several hundred judicial real estate transactions.